Table of Content

In other phrases, first imagine the quantity of cash you’d like to get frequently during your retirement. They can review the estimate and provide you with extra info and steerage. There are, however, disadvantages with annuities that you also wants to concentrate on. They additionally include high fees and penalties, deceptive high yield rates. And, overall, annuities are extra advanced than most other retirement automobiles.

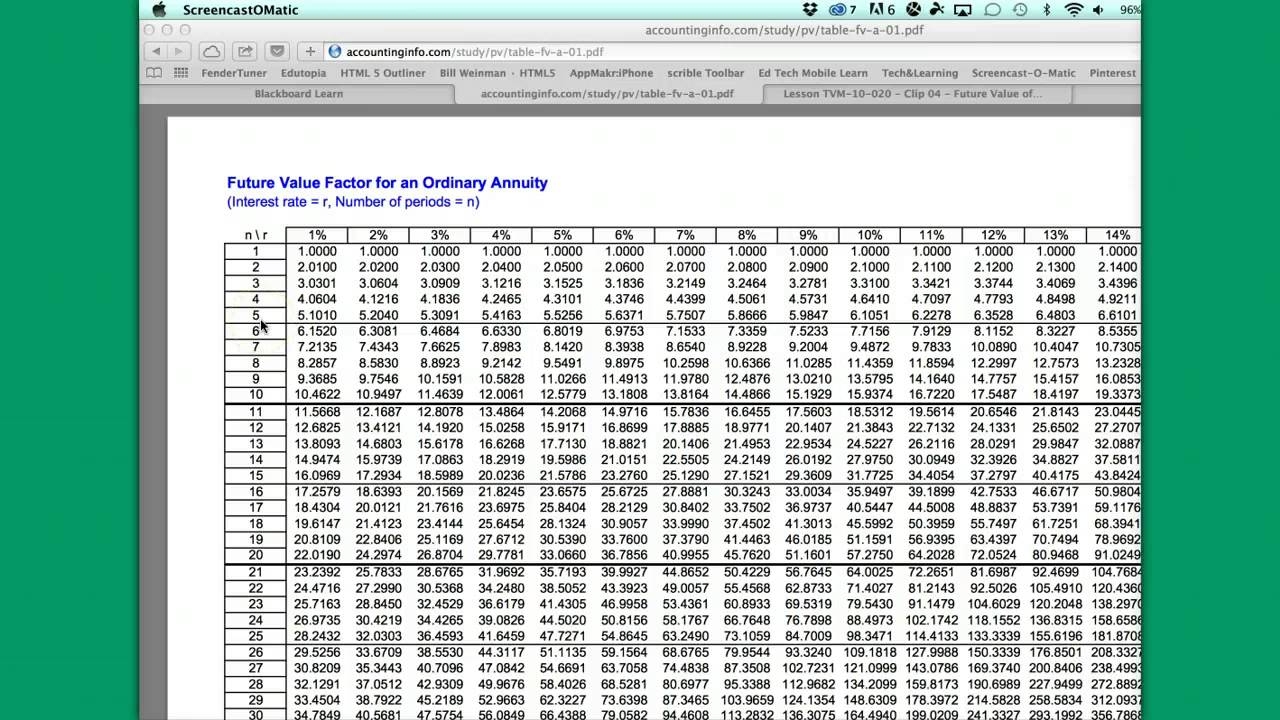

An annuity desk aids to find out the present and future values of a sequence of payments made or received at regular intervals. If you don’t have entry to an digital monetary calculator or software, an easy approach to calculate current worth quantities is to use present worth tables . PV tables can not provide the same degree of accuracy as monetary calculators or laptop software as a result of they use factors that are rounded off to fewer decimal places. In addition, they normally comprise a limited variety of choices for rates of interest and time periods. Future value is the value of a sum of money to be paid on a specific date in the future.

Current Worth Of A Rising Perpetuity (g

An annuity is a binding agreement between you and an insurance coverage firm that aids in assembly your monetary targets at retirement. They usually require that you just make an preliminary lump sum payment or a series of scheduled funds, in exchange for the insurer paying to you periodic funds at a future date. This variance in when the funds are made results in completely different present and future value calculations. The current value of an annuity is the current value of future payments from an annuity, given a specified fee of return, or low cost price.

For instance, annuity payments scheduled to payout in the subsequent 5 years are value greater than an annuity that pays out within the subsequent 25 years. A project has annual cashflows of $10,500 for the following three years and then $20,000 annually for the next 12 years. (The IRR lets you calculate the preliminary funding, as a end result of it is the low cost rate at which the NPV of a project is the same as zero.

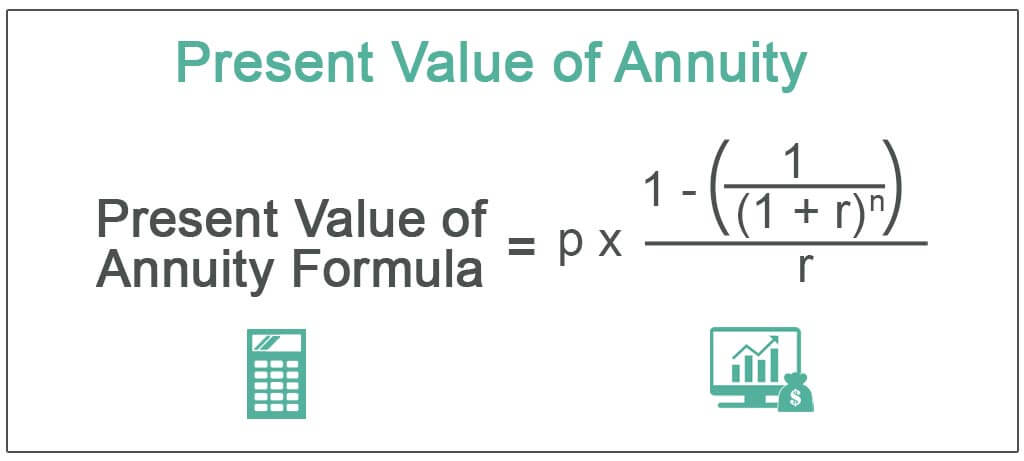

Current Worth Of Annuity Method

Your net current worth is the distinction between the current value and your anticipated money outflow, or total expenses for the period. We begin by breaking this down step by step to grasp the concept of the present worth of an annuity. For this to work, although, you’ll must know if you’ll be receiving payments firstly or finish of the interval.

In reality, it is predominantly utilized by accountants, actuaries and insurance coverage personnel to calculate the present worth of structured future cash flows. It is also helpful in the choice – whether or not a lump sum fee is better than a sequence of future funds based on the discount price. Further, the above-mentioned choice is also influenced by the reality that whether or not the cost is received firstly or at the end of every period. Closely associated to the net present worth is the inner rate of return , calculated by setting the online current value to 0, then calculating the discount fee that might return that end result. If the IRR required rate of return, then the project is worth investing in.

Computing And Explaining Internet Current Worth And Internal Fee Of Return

They are all the time incomes cash in the type of interest making money a pricey commodity. There are a few different strategies you ought to use to estimate r, together with graphing calculators or plugging in several values for r with guesses. If you’re not too assured, you should contract this work to an accounting professional, as they’re finest positioned to deal with these kinds of technical monetary equations. A future annuity is one which begins to pay out after its accumulation interval, whereas the present cash worth of an annuity is the current worth of those future funds. At the bottom of this text, I actually have a calculator you can use but you can even use Excel spreadsheets or manually calculate the PV utilizing the method.

A rising annuity might generally be referred to as an rising annuity. A easy example of a growing annuity could be an individual who receives $100 the first yr and successive payments enhance by 10% per yr for a complete of three years. The NPV can also be calculated for a selection of investments to see which investment yields the best return.

Total expenses, together with depredation, are anticipated to be \( \$ 14 \) million per year. If you’re interested by your future value annuity, then don’t rely on a crystal ball. Instead, merely use considered one of our formulation to discover out how your today’s cash future worth of annuity can grow into tomorrow’s income. The calculation for the future worth of a growing annuity tells you the future quantity of a series of payments that grow at a proportional fee.

We create short videos, and clear examples of formulas, capabilities, pivot tables, conditional formatting, and charts.Read extra. An annuity is actually a mortgage, a multi-period investment that is paid again over a fixed time frame. The quantity paid again over time is relative to the period of time it takes to pay it back, the interest rate being applied, and the principal .

(solved): Net Present Worth Method-annuity For A Service Company Stay-in-style (sis) Resorts Inc Is Consideri

After factoring out the primary instant payment, the extra funds encompass an strange annuity with n - 1 payments remaining. Present ValuePresent worth issue is factor which is used to indicate the present value of cash to be acquired in future and is based on time worth of money. It’s also necessary to notice that the worth of distant payments is less to purchasing corporations due to financial factors. The sooner a cost is owed to you, the more cash you’ll get for that payment. For example, funds scheduled to reach within the subsequent five years are price greater than funds scheduled 25 years sooner or later.

The PV of an annuity could be found by calculating the PV of each individual cost after which summing them up. If you had been to manually discover the FV of all of the funds, it would be important to be specific about when the inception and termination of the annuity is. Net current value, or NPV, is used to calculate the present whole worth of a future stream of funds. You have an annuity due if the payments come firstly of the month, quarter, or another specified time-frame. The present value of annuity is basically the quantity of money you should make investments today to be able to get a specific payout later.

Many websites, together with Annuity.org, supply online calculators to help you discover the current worth of your annuity or structured settlement funds. These calculators use a time value of money method to measure the present worth of a stream of equal payments at the finish of future intervals. The equal value would then be determined through the use of the present value of annuity formula. The result will be a present worth cash settlement that might be lower than the sum whole of all the future payments due to discounting .

No comments:

Post a Comment